The problem I have with eBay feedback is the positive ones are usually so over the top. “A1++++++++++++++ great ebayer!!!!!” is really too much when usually it just means the person in question sent the parcel/money on time, and answered emails. I prefer to put a little more actual information in the feedback I leave.

Monthly Archives: May 2007

TiVo coming to Australia

Channel 7 has announced a partnership with TiVo to introduce the service in Australia. Age story. TiVo press release.

For those who can’t wait, and are willing to do some hacking, there’s always OzTivo, of course. Other countries blessed with TiVo include the UK, US, Canada and Taiwan, with Mexico getting it soon.

Quick reminder for Aussies

You’ve only got a few hours left to get that cheap Microsoft Office 2007 for A$75… all you need is a student at an Australian university.

On the other hand, employees of companies that are in Microsoft’s Home Use Program can get it any time, for around A$40. Worth checking with your local IT people.

Games, games, games

The Age reports that the ACMI Games Lab in Melbourne will be hosting the Game On exhibition of video game history, which has already been seen in London, Chicago and San Jose. Should be a nice followup to the Melbourne House/Beam Software exhibit they had recently.

The Age reports that the ACMI Games Lab in Melbourne will be hosting the Game On exhibition of video game history, which has already been seen in London, Chicago and San Jose. Should be a nice followup to the Melbourne House/Beam Software exhibit they had recently.

Speaking of games, ArsTechnica continues its series on writing in games (eg plots and backstories, rather than code).

Meanwhile in Australia there’s more campaigning for the OFLC to be allowed to give games an R 18+ rating (rather than having to refuse them classification), to bring games ratings into line with movies.

Though interestingly, a catalogue from discount chain KMart that arrived during the week reckoned Grand Theft Auto Liberty City Stories is rated R — it’s actually MA15+.

The out-of-control Inbox

I’m one of those people whose Inbox slowly gets out of control. Here’s a good article on dealing with it: How to crank through your Gmail. (via Scoble) Of course, the trick for me is finding the time to do the initial cleanup.

I’ve actually almost managed it on my work Inbox. I got it to the stage where there is usually less than a screenful of emails. Virtually everything else goes into a folder called Inbox Archive, which is my Outlook equivalent of GMail’s archive. Of course, if I leave it unchecked for a day or two, the Inbox fills up again.

Got to keep at it constantly.

Firefox Spellcheck dictionary

A couple of times now I’ve had to hunt down the location of the dictionary for Firefox because in the popup for a misspelled word has ‘Add to dictionary’ too close to the word I want to change to (and now I’ve inserted a misspelling into my personal dictionary).

The location of the dictionary for Firefox (under Windows) is: somewhere under Documents and Settings is the file persdict.dat.

Maybe this time I’ll remember it. I suggest this behaviour shows a usability problem.

Communication with pre-vocalisation humans: a review

Earlier I mentioned that Cathy and I were trying to communicate with Owen using sign language. I’m here to report how that went.

It took a while. Our signing was persistent, and eventually we started seeing him signing back at us, although because of his impaired fine motor skills (what with being a baby and all) he didn’t do a good job of making the “correct” or taught signs. But we knew what he meant, and we consistently “corrected” him (by repeating our understanding back using the right sign), and saw no change. Once he’d figured out the sign for something, and he was getting the right response, he was happy. It took more than six months for him to change his sign for Cat from his personal sign (sticking his fingers to his lips) to that similar to the right one (pulling at whiskers on your face). He’s still signing “more” incorrectly, but we know exactly what he means – and he couples it with a spoken “Mor” nowadays.

One thing that I noticed was that his vocabulary was expanding steadily, until it suddenly collapsed. And that coincided with him beginning to vocalise – as soon as he started making distinguishable sounds, it seemed like all the hand signs fell out of his head. They’ve slowly returned, but it was a major disappointment to go from understanding most of his wants to understanding few of them.

A downside of sign language is that it’s hard to read in darkness. So going to a crying baby in the middle of the night and getting him to tell me what was wrong/what he wanted didn’t work so good.

In balance, I’d say that signing helped a lot. Owen’s a very calm child, which I partially attribute to his ability to tell his parents what he wants – and when we’re able to tell him that we understand, but he’s not getting any more chocolate until tomorrow, his frustration isn’t due to a communications failure.

More broadband in Crikey and the ABC

Economist Joshua Gans has taken up my cause of “what the hell do we need fast broadband for?” in CoreEcon More broadband in Crikey and the ABC – he asks, “why should we give money/monopoly rights/subsidization to Telstra to create a higher speed network? If there was some economic benefit in it then it would fund itself.”

Would someone please ask Kevin Rudd that same question? Please don’t spend $10b of my taxes so that pimply-faced teenagers can download porn faster.

Japan and Korea has pervasive 100Mb networks. Has there been a big business uptake? No, they’re using that bandwidth for gaming. Don’t get me wrong, gaming’s great and all, but I’d rather you spent my tax dollars on… I dunno… stopping global warming. If I want to game, let me spend my money on it, not the taxpayers’.

It used to be that TV was the opiate of the masses. Now it appears to be downloadable video is.

Josh on Housing – Part 2

My local library has magazine back issues. I was reading a Money, August 2004 article by Paul Citheroe, entitled am I better off Renting or buying a home? on pg 22.

Virgin home loans are now available at 7.34%pa. That’s pretty darn cheap. But still not as cheap as my preferred lender, HomePath (a Commonwealth bank subsidiary). All this cheap money, someone should buy a house, right?

I advocate two positions. One I advance to those people I know that are good savers. That is, buying a home is for suckers. The other I push on those whose money management… leaves something to be desired. Perhaps they show the kind of financial restraint that the Enron accountants did. Anyways, to them, I say “buy a house. Now. Are you still here? Go on, get!”

Paul agrees with me, sort of. He thinks that we’re all spendthrifts, just because our country is going into the hole at $2b/month:

Given our poor track record as savers, I fear that you won’t “rent and buy shares.” You’ll rent and blow the money on lifestyle, leaving you in the situation at retirement with no house and no investments.

But, he says, that’s irrelevant, because of the figures in the article which show you’re better off buying real estate, regardless of the alternative of saving while renting. He give enough hints in the article that I might be able to reproduce his (well, the Macquarie Bank’s) workings and then refute his proposition.

Let’s see:

| Buy and repay | Rent and invest | |

| Capital Gain | 8.7%pa | 8.1%pa |

| Income | – | 4.12% dividend (what’s the franking level?) |

| Txn costs in | $8586 | 1 month’s bond ($14,300), 1% on shares |

| Txn costs out | 2%? | 1% |

| CGT | – | 50%? |

| Holding costs | $30,543pa interest + ~$3,700pa rates, insurance, etc |

$14,300pa indexed |

Shares at 8.1% capital gain, 4.12% dividend (what’s the franking level?). Actually, the long term average is about 10% gain; perhaps that’s with taxes paid and dividends re-invested. Don’t know about average dividends or franking levels. 8.1%pa growth for property matches my understanding, which is a long term average of 8%.

Shares with a 1% broker fee (you’d be hard pressed to pay that kind of fee, it ought to be more in the $50 range).

CGT at the marginal rate – I wonder if they 50% discounted it? CGT will only be payable on realization of the asset, which might not happen.

Strata levis (etc) increasing at 3%pa ($19,219 total by year 5), rental of $14300 (figure from NSW dept of housing for 2br flat) increasing at 5%pa ($78,890 total by year 5). I presume these figures are reasonable. Except, $337,500 property (average Sydney property) – is this the same property as the 2br flat used to calculate rent, or is it a better property?

Already I can see a problem – the yield on the property is incomparable to reality. I don’t think they’re comparing apples with oranges – $14,300 rental on a $337,500 flat is about a 4% yield, and you generally don’t see that high a gross yield. More like 2%, perhaps 3%.

30% marginal tax rate, $39086 in savings (questionable), $7K First Home Owner Grant (you might get more than that), acquisition/loan establishment costs of $8586, no stamp duty – (Flash stamp duty calculator, or non-flash) – but no stamp duty is unlikely.

1 month’s rent as bond. Agent fees on property realization 2% (this assumes no advertising etc costs, which is highly unlikely) – I don’t know why they’re indexed at 3%.

Initial mortgage of 337,500 at 7.6%pa fixed for 25yrs $30,543pa.

As he stated, he ignored reno costs of IBISWorld estimated $500pa – a lot on the low side by my figuring, and something your landlord picks up the tab on. You’re going to lose the hot water service every ten or twenty years, a new fence, new carpets, kitchen cabinets, curtains, a lick of paint every five years, new taps every twenty, light fittings, etc. Every 50-100 years you’re going to need to replace the whole house. It all adds up, even if all you’re paying for is materials.

Okay, what about HECS and Medicare? As your taxable income goes down, so do these components.

The analysis wasn’t controlled so that the take-home was the same for both parties. It would have allowed a tax-deductible margin loan to ramp up the share exposure. Apples with apples!

So, after all these random bullet points, I’ve decided that the analysis was flawed, and heavily biased towards home purchase. I did a similar analysis six years ago, and renting came out ahead of borrowing to buy. But the real money was in buying, and then mortgaging to purchase shares. But the spread between margin loans and home loans was a lot larger back then.

For a US-centric view on things, read Misconception: Renting is for Suckers. There, home loan interest is deductible from tax (you can get a similar arrangement here, if you are able to jump through the significantly large hoops).

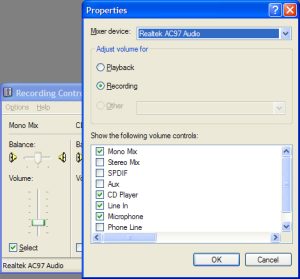

The easy way to record any audio playback in Windows

People jump through all sorts of hoops trying to record audio direct from the source, which is particularly tricky when it’s a WMA or Real streaming cast.

But it’s actually dead simple to do this, at least for short periods: (Instructions for Windows XP)

1. Double-click on the Volume Control speaker in the taskbar. The full Volume Control will open up, with lots of different levels.

1. Double-click on the Volume Control speaker in the taskbar. The full Volume Control will open up, with lots of different levels.

2. Click Options / Properties. Then in Adjust Volume For, choose Recording. Then make sure either Mono Mix or Stereo Mix are turned on. (Obviously Mono is sufficient for streaming of AM radio stations, for instance.) Then click OK.

3. The recording levels will then be displayed. Click on Select for the Mono or Stereo Mix option you’re going to use, and adjust the volume to something sensible. This will tell Windows which of the many “inputs” you wish to record audio from.

4. Leave the recording levels visible, and go and open Sound Recorder, as well as whatever sound source you want. When you click Record in Sound Recorder, you should find it successfully records whatever sounds are outputting from the computer at the time. Adjust the volume level to suit.

As many know, Sound Recorder will only record up to 60 seconds at a time. So it’s not perfect, but it is built-in to Windows, so everybody has it, so it’s a good quick’n’dirty solution for short recordings.

I’d assume that other recording tools that can record for longer periods would also use the Volume Control applet to choose which input they’re taking. At least I hope so.

H-E two sticks?

From a recent interaction with a Canadian:

Accordingly, we’re trying not to get too far ahead of everyone while still innovating like H-E two sticks.

“Huh?” says I.

No worries, I can shuffle around this odd bit of language. I’ll Google it.

Not a lot of people (16) using the term. Then it twigs:

Oh, for fuck’s sake.

Snippets of interest

Jon Galloway on how to avoid RSI by ditching the mouse, with particular attention to web browsing, which is one of the hardest things to do with just a keyboard.

(My particular pet hate is that even Alt-D to get to the address bar can get disabled when a web page has Flash on it.)

Telstra Sensis and NineMSN have clubbed together with mylocal.com.au to try and fight off the onslaught from Google (who have data from truelocal.com.au).

Long Zheng has a great piece on the next steps for GUI environments, pointing out that, really, they haven’t changed all that much over the years.